18% QoQ growth registered with cumulative devices’ shipments touching 18.2 million in 2Q’16

- Samsung, Micromax and LYF are the top three LTE devices players with 40%, 9% and 8% market shares, respectively.

- Time ripe for Apple to ship promised VoLTE enabled iPhones that would work on Reliance’s Jio network.

- Second tier of handset manufacturers like Vivo, Oppo, LeEco, Gionee, OnePlus and InFocus to double their 4G shipments to meet the surge in demand as Jio goes live.

- 4G Smartphones continue to dominate the space, however, CMR expects data cards and tablets to double their shares and contribute between 3-4% to the overall LTE devices shipment by the year-end.

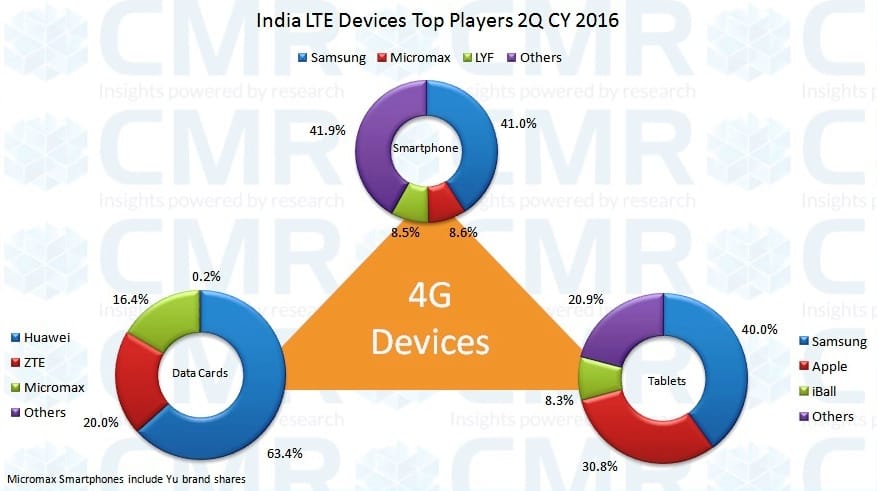

Gurugram: As per the CMR’s 2Q CY 2016 report of India LTE Devices, over 18.2 million 4G devices were shipped in the second quarter of 2016 as against 15.4 million in the first quarter. Of these, 97.8% were Smartphones followed by DataCards at 1.6% and Tablet PCs at 0.6%.

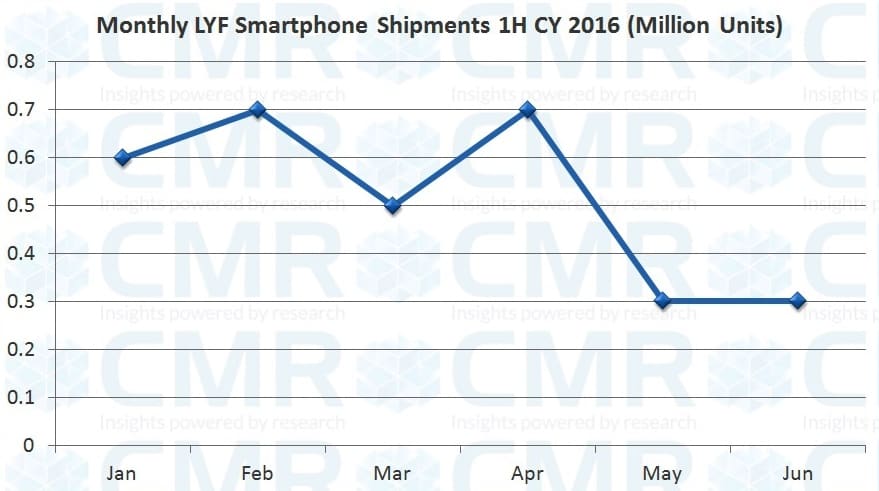

Samsung still rules the market with about 40% market share, beating Lenovo, Micromax and LYF took the second and third positions with 9% and 8% market shares, respectively. However, as trends suggest post April 2016, shipments of LYF devices are witnessing a decline and it may not remain a leading brand in the coming quarters. However, its share into tablets is likely to increase that would also give a fillip to Mi-Fi devices, where Jio is selling Huawei’s Mi-Fi devices.

In the mobile phones, Samsung, Micromax and LYF are the three leaders with 41%, 8.62 % and 8.54% market shares, respectively. In tablets, Samsung held 40% market share, Apple was at second position with 30.79% market share and iBall was ranked number 3 with 8.3% share. However, within DataCards, Samsung, ZTE, Micromax and iBall were the only players shipping 4G devices in the 2Q of 2016. With the top three players holding 63.39%, 20.02%, 16.43%, markets shares, respectively.

In the backdrop of declining LYF Smartphone shipments and with enablement of almost all leading brands for provisioning of Jio services and the services actually going live, it is high-time for the second tier brands like Vivo, Oppo, LeEco, Gionee, OnePlus, Asus and InFocus to double their shipments to meet the expected rise in demand. Of this, LeEco and OnePlus should also get their devices work on the Jio networks.

Commenting on the findings, Faisal Kawoosa, Principal Analyst for Telecoms at CMR, said, “Now the equation is reversed. First, all handset vendors wanted to ride on the expected 4G wave. With services becoming live, it will be now more of a concern for operators, especially Jio (since it is a 4G only network) to actually see the ecosystem gets widened and encourage more and more handset players to come onboard and ramp up their shipments.”

”The biggest challenge for Jio would be to double the users actually having a 4G device in hand. We expect this year to end with around 125 million cumulative 4G devices and Jio would want this base to touch 250-300 million by 2017 end. Only then, it can expect some decent numbers (70-80 million) of subscribers on Jio services of this potential base by the end of 2017,” Faisal added.

CMR Analyst for Telecoms, Krishna Mukherjee, commenting on the 4G LTE brands in India said, “While in the Smartphone space, we may see about 25-30 4G Smartphone models with different variant getting launched in the second half of this year and content and video consumption getting a boost with 4G. And to fulfill the tremendous demand for 4G, the second tier of handset brands such as Vivo, Oppo, LeEco, Xiaomi, having created a niche for them in the India market, should explore more and take on the 4G wave.”

“4G LTE is here now to turnaround the tablets and data cards market as more and more players see this arena as the potential cash cows of the future. Not only domestic, but global brands should also look at this space to yield maximum profit from this unexplored space. In a nutshell, after the success in Smartphones, 4G is likely to revitalize the tablets and data cards segments and so, they could be the next destination for success,” Krishna concluded.

NOTES TO EDITORS

- This release is based on CMR’s Quarterly India LTE Devices Report.

- CMR uses the term “shipments” to describe the number of devices leaving the factory premises for OEM sales or stocking by distributors and retailers. For the convenience of media, the term shipments is sometimes replaced by ‘sales’ in the press release, but this reflects the market size in terms of units of devices and not their absolute value. In the case of devices imported into the country it represents the number leaving the first warehouse to OEMs, distributors and retailers. CyberMedia Research does not track the number of devices brought on their person by individual passengers landing on Indian soil from overseas destinations or ‘grey market’ devices. These are, therefore, not part of the CyberMedia Research numbers reported here.

- CMR tracks shipments of devices on a monthly basis. However, as per convention, the market size is reported on a calendar quarter basis where appropriate to the context; in all such cases this refers to an aggregated number for the three calendar months in the quarter to which the press release refers.