SanDisk remained most favoured brand

Market traction towards higher capacity SKUs

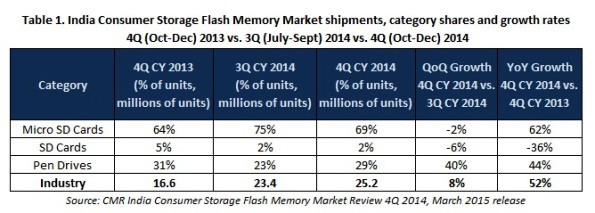

New Delhi / Gurgaon: The India Consumer Storage Flash Memory market comprising Micro SD cards, SD cards and Flash drives, continued its growth in 4Q CY2014, witnessing a 52% year-on-year growth and 8% sequential growth in terms of units shipped.

While the annual growth was contributed by Micro SD cards and Pen drives alike, sequential growth largely came from the Pen drives (Flash drives) category, which recorded a 40% sequential growth in 4Q CY2014. This was revealed in CMR’s India Quarterly Consumer Storage Flash Memory Market Review, 4Q CY 2014, March 2015 release.

Market Leadership

In the overall India Consumer Storage Flash Memory market SanDisk maintained its top spot with a 31% market share in terms of unit shipments during 4Q CY2014. SanDisk was a leading vendor in all three categories. Transcend followed SanDisk at number two spot with an 11% market share in unit shipment terms. The top 6 vendors witnessed sequential growth in their respective shipments in 4Q CY2014 over 3Q CY 2014.

Capacity Trends

In terms of capacity 8GB continued to be the leading contributor with a 38% market share in terms of unit shipments. This market leading SKU witnessed a 53% year-on-year growth in terms of unit shipments.

“In 4Q CY2014 the market continued to show traction towards higher capacity SKUs. Over a period of time market has moved from 4GB to 8GB as the flag-bearer product. In fact, the market witnessed a negative growth in the ‘entry level’ 2GB and 4GB capacity segments during the quarter” stated Narinder Kumar, Lead Analyst, InfoTech and Channels Practices, CyberMedia Research.

“Rapid increase in data consumption and content creation from light weight computing devices like mobiles and tablets has resulted in a growing demand for higher capacity consumer flash storage. As a result and due to the trend of declining price gap between SKUs of various capacities, consumers are finding it easy to shift to a higher capacity flash memory device” Narinder concluded.

Notes for Editors

- CyberMedia Research (CMR) is a pioneering market intelligence and consulting firm that runs a comprehensive quarterly market update on the India Consumer Storage market. CMR’s India Quarterly Consumer Storage Flash Memory Market Review covers Micro SD cards, SD cards and Flash drives sold via distributors and retail outlets. It does not include bundled or ‘grey’ market shipments or units brought from abroad by individuals as a part of personal baggage.

- CMR uses the term “shipments” to describe the number of consumer storage flash memory devices leaving the factory premises for OEM sales or stocking by distributors and retailers. For the convenience of media, the term ‘shipment’ is sometimes replaced by “sales” in the press release, but this reflects the market size in terms of units of consumer storage flash memory devices and not their absolute value. In the case of flash memory devices imported into the country, it represents the number leaving the first warehouse to OEMs, distributors and retailers.