SanDisk retains No. 1 spot, shipments from unbranded players increased by 75% sequentially

8 GB remains favorite SKU amongst consumers

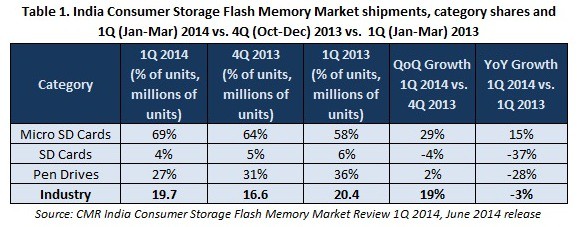

The India Consumer Storage Flash Memory market comprising Micro SD cards, SD cards and Flash drives, registered an impressive sequential growth of 19% in 1Q CY 2014, recording 19.7 million unit shipments. Growth in this quarter can be largely attributed to price stability of consumer storage flash memory products over the past couple of quarters. This was revealed in CMR’s India Quarterly Consumer Storage Flash Memory Market Review, 1Q CY 2014, June 2014 release.

Market Leadership

In the overall consumer storage flash memory market; SanDisk maintained its market leadership with 35% market share by unit shipments, on the back of a 16% sequential growth in 1Q CY 2014. SanDisk continued to lead across all three product categories. Transcend was at second spot, followed by Kingston at third spot during the quarter.

Favourite SKU Capacity

The 8 GB capacity segment remained the favourite SKU, contributing 37% of overall unit shipments, and registering a sequential growth of 16% in 1Q CY 2014. The 2 GB capacity segment whose market share by shipments had declined over the past two quarters turned around in 1Q CY 2014 with a 28% sequential growth.

Major vendors had gradually vacated the 2 GB space and moved towards higher capacity offerings due to low margins. However, this quarter (1Q CY 2014) saw a surge in shipments of 2 GB capacity offerings from unbranded players in the Micro SD cards category, mainly due to stability in prices over the last two quarters. Collective shipments from these unbranded players grew by a steep 76% in 1Q CY 2014, as compared to the previous quarter.

“Unbranded players largely operate in the entry level 2 GB and 4 GB capacity segments with their offerings at comparatively lower prices than branded players in the Indian market. Shipments brought in by these unbranded players are expected to grow in the forthcoming quarters, and likely to impact the business of branded players, especially in the 4 GB capacity segment”, stated Narinder Kumar, Analyst, InfoTech and Channels Practices, CyberMedia Research.

“Currently, the India mobile handsets market has a large segment of sub-Rs. 2,000 devices with memory slots. These phones don’t come bundled with memory cards. This segment of mobile handset users is the most likely target of unbranded players, who are concentrated mainly in Tier-II and smaller cities”, Narinder added.

Notes for Editors

- CyberMedia Research (CMR) is a pioneering market intelligence and consulting firm that runs a comprehensive quarterly market update on the India Consumer Storage market. CMR’s India Quarterly Consumer Storage Flash Memory Market Review covers Micro SD cards, SD cards and Flash drives sold via distributors and retail outlets. It does not include bundled or ‘grey’ market shipments or units brought from abroad by individuals as a part of personal baggage.

- CMR uses the term “shipments” to describe the number of consumer storage flash memory devices leaving the factory premises for OEM sales or stocking by distributors and retailers. For the convenience of media, the term ‘shipment’ is sometimes replaced by “sales” in the press release, but this reflects the market size in terms of units of consumer storage flash memory devices and not their absolute value. In the case of flash memory devices imported into the country, it represents the number leaving the first warehouse to OEMs, distributors and retailers.