The overall A4 printer sell-throughs in India’s top 65 cities crossed 5.5 lakh units during the Jan-March 2012 quarter. Laser printer sell-throughs in top 65 cities grew 4% in 1Q 2012 over 4Q 2011 while Inkjet printer sell-throughs fall 5% sequentially. The overall market recorded a mere 0.4% growth. This was reported in the India 65-City Monthly Printer Market Review, 1Q 2012 published by leading IT, Telecommunications, Semiconductor & Electronics market intelligence firm, CyberMedia Research.

“The weak macroeconomic outlook and Hard Disk Drive supply chain dynamics did not help the India printer market register healthy growth rates,” stated Sumanta Mukherjee, Lead Analyst, CyberMedia Research InfoTech Practice.

“A weaker Rupee is exerting pressure on vendors to increase printer prices ahead of the coming festive season. This may not act as the perfect incentive to lift the sombre mood of the market”, Sumanta added further.

The contribution of laser printer sell-throughs to overall India A4 printer shipments increased 2 percentage points, while that of inkjet sell-throughs declined by over 2 percentage points in 1Q 2012 vis-à-vis 4Q 2011.

The trends in the last three quarters (3Q 2011 vs. 4Q 2011 vs. 1Q 2012), contribution of laser printers as category has increased by 5% points, while that of inkjet printers has declined by 5%.

While the modest demand from the domestic SMB enterprise base triggered a growth in the laser Multi Function printer category, the lack of a strong consumer demand deserted inkjet printer growth in 1Q 2012.

Category Play: HP stays #1, but loses share

In the overall India A4 printer market, HP maintained its leadership position with 56% share in terms of sell-throughs (units), followed by Canon, Epson, and Samsung in that order. While HP lost share in both inkjet and laser categories in 1Q 2012 vis-à-vis 4Q 2011, Epson gained share in the inkjet segment, while Canon gained in both.

In terms of Inkjet A4 Printer sales, HP led the market with 71%, followed by Epson and Canon, respectively during 1Q 2012.

In terms of Laser A4 Printer sales, HP retained the top spot with a 53% units share. Canon and Samsung grabbed the second and third places, respectively.

In DMP sales, Epson was the leader with 49% share of unit sell-throughs, followed by TVSe and WeP.

Growth in laser multifunction printer penetration was prominent in West and South. Laser as a category displayed growth and attracted vendor focus. Irregular supplies of the top selling 1020+ held back HP in the laser segment. Epson, the latest entrant to the laser category in December 2011, has the potential to leverage on the reasonably successful models of M-1400 and MX-14, which are aggressively priced.

Further, the introduction of L100 and L200 helped Epson gain share in the inkjet printer market, while E500 generated traction for Canon.

Regional Play

In the inkjet printer category, over the last three quarters (3Q 2011 vs. 4Q 2011 vs. 1Q 2012), HP lost share in Eastern India and Northern India to Canon and Epson, in particular.

In the laser printer category, during the same period, HP gained share in terms of sell-throughs in Eastern, Southern and Western India, while holding fort in the North. Canon and Samsung lost share in these regions, allowing HP to consolidate.

The Road Ahead

“The inkjet multifunction printer market had been growing steadily. With improvements in technology and TCO coming down over the years, this category has found greater acceptance in the home and SMB enterprise segments and in some cases, with corporates as well. But in the absence of a buoyant consumer / SOHO sentiment, it will remain affected in the near- to short-term”, stated Maninder Singh, Analyst, IT Channels Research, CyberMedia Research IT Practice.

“A dull market has influenced channel partners’ preference for trade promotion schemes. Partners would prefer to avail on-the-spot ‘cash’ discounts, as opposed to overseas trips and backend incentives. This reflects the increasing importance attached to managing cash flows better, in a high interest rate regime”, Maninder further surmised.

Notes for the Editors

1) A4 printer market for channels is based on sell-throughs of Tier II printer dealers across the Top 65 cities of India.

2) It covers 8 major vendors HP, Canon, Samsung, Epson, Xerox, Brother, TVSe and WeP, and other small vendors.

3) It does not include Institutional and LFR (Large Format Retail) sales by vendors.

4) Technology wise categories covered include laser multi-function, laser single function, inkjet multi-function, inkjet single function and dot matrix printers.

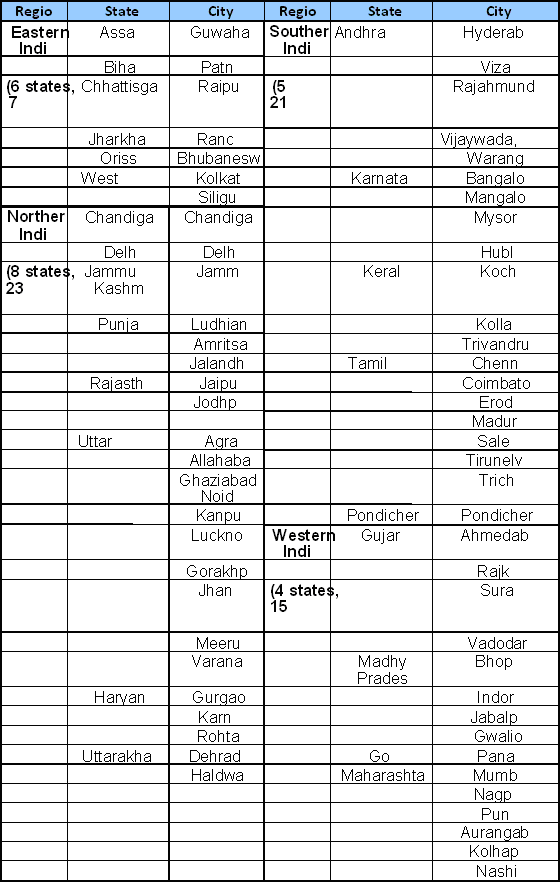

5) The Top 65 cities of India covered by the CyberMedia Research India Monthly City-Wise Printer Market Review, 1Q 2012, May 2012 release are classified under the following geographical regions: